Last Updated on January 16, 2024 by BVN

Phyllis Kimber-Wilcox

California has long been identified with car culture.

There’s the everyday car thing here in California —congested freeways, long commutes and traffic, everything spread out everywhere.

But there’s also that other car thing . . . the one people cruised to, low-rode to, and hit corners to. It’s the car culture so often portrayed in the movies, on television and on the radio. Thinking of media separately is no longer correct—if it ever was—because everything is in the stream now. That tells you how long that California love for the automobile has been going on. Long before there was a stream, Cali and cars have been a thing.

Another indication of where you are in the time continuum is that the very thing you are known for becomes dated, and the thing not to be. Not without good reason of course. Walkable neighborhoods and places that are navigable without a car are currently very desirable. Depending on where you live, you can bike, scoot, or drive a rental car parked on the street– with a credit card and enough money, of course. But for many Californians, a personal car is the only way to get to the places they need to go, and many of those places aren’t walkable.

Cars are expensive and still one of the most important purchases that a buyer can make. Unfortunately, some auto dealers and sellers take advantage of the public by engaging in what are called auto retail scams. This type of scam or fraud costs consumers billions of dollars each year.

In response, the Federal Trade Commission (FTC) which protects the public from unfair business practices has created the Combating Auto Retail Scams (CARS) rule. The rule protects the public from auto retail scams or fraud when they buy cars.

The rule, which requires transparency in the vehicle shopping process, includes key provisions regarding pricing, add-on products and services as well as buyers’ consent.

Fraud or Scam

For most people the words fraud and scam are interchangeable, and Malini Mithal, Associate Director of the Federal Trade Commission (FTC) Division of Financial Practices concurred, “There’s not actually much difference,” he explained. “A lot of times if someone is lying to you about a product that’s fraudulent behavior. That’s a fraud, [and] it can be called a scam as well. The reason we use the term scam is that sometimes it’s a little bit broader.”

When it comes to scamming the public the intent of the scammer is not the focus according to Mithal. “Sometimes people think the word fraud has to include intent that you did something on purpose which is not necessarily what’s needed under the FTC Act. We’re very focused on what a consumer thinks, regardless of whether the speaker was intending something or not.”

Although some consider fraud more of a legal term according to Mithal, acknowledging there are different legal standards in court. However, in our day to day speaking, scam “is a broad word that encompasses fraud and other illegal conduct.”

What is the CARS Rule?

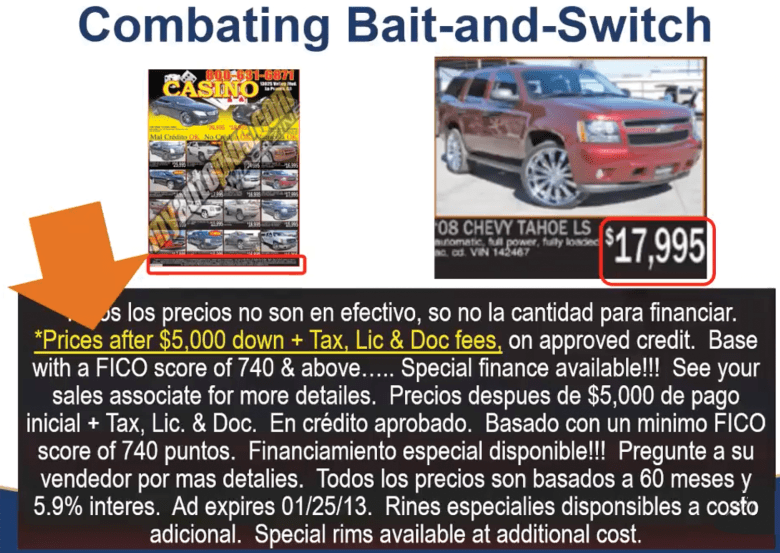

Explaining the CARS Rule, Mithal shared that it focuses on two very harmful practices that consumers experience beginning with “bait and switch” tactics, where dealers advertise a certain deal like a low price, to get you to come to the lot. But, once you’re there and you spend time on the lot, you learn that the car is way more expensive than what was advertised.

The second scam the new rule aims to combat is “junk fees” which primarily refers to hidden charges that the dealer and consumer have never spoken about and the consumer doesn’t want and that are easy to hide in contracts. This can include such items as extended warranties, guaranteed automobile or asset protection or so-called “GAP” agreements, VIM etching, coatings that are supposed to protect the vehicle and many other items.

Mithal went on to say that the rule will save money and time. Honest car sellers and dealers will also be helped by the new rule because they will not have to compete with scammers, fraudsters and their fraudulent practices.

The rule states dealers can’t lie about terms or conditions Dealers also must tell consumers the offering price that’s the actual price anyone can buy the car for and consumers don’t have to buy add-ons. Consumers must also be told what each charge is for and agree to pay it.

Fraud A Preventable Crime

Older adults are often the target of unethical auto dealers. In addition to the fraudulent tactics detailed above, such dealers frequently conceal the poor condition of used cars and often lure consumers with advertisements of cars they do not have or do not intend to sell. These are other examples of “bait and switch.” Other dealer scams can include attempting to inflate the interest rate at the time of financing.

The Consumer Fraud Investigations Unit of the Riverside County District Attorney’s Office advises that in order to prevent fraud, the public must educate itself advising, “As the first line of defense against fraud, consumers must be constantly on guard.”

Consumer fraud is a uniquely preventable crime, the Riverside County Fraud Unit advises on its website advising, “By learning about current rip-offs in the marketplace and by following basic tips on smart consumer behavior, you can protect yourself and help us protect all the consumers of Riverside.” The new FTC CARS Rule becomes effective July 30, 2024.